This guide aims to answer the following question: “what are the best allotment loans for postal employees?”

If you’re a postal worker and need money to cover an emergency expense, you qualify for an allotment loan that lets you borrow money against your future paychecks.

At Stately Credit, we are committed to ensuring that our prospective borrowers are informed of options when searching for allotment loans that meet their needs.

While we believe our allotment loans are among the best in the industry, we compiled a list of the top allotment loan companies for postal employees to help you better understand the market and focus your search.

Please continue reading our list below to learn more about these providers and what they offer, in no apparent order.

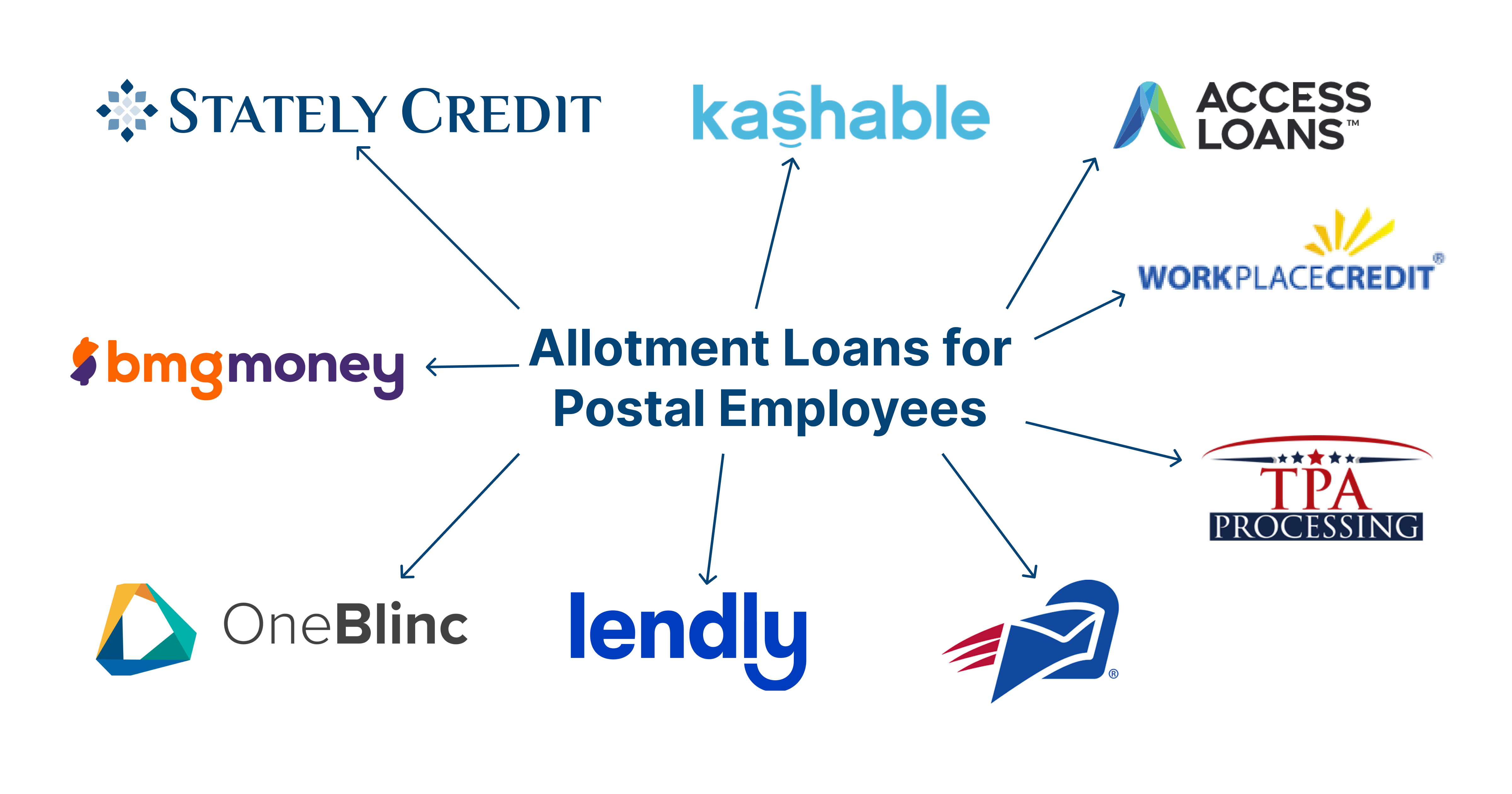

9 Best Allotment Loans for Postal Employees

- Kashable

- OneBlinc

- BmgMoney

- Lendly

- USPS FCU

- Workplace Credit

- TPA Processing

- Access Loans

- Coast 2 Coast Lenders

1. Kashable

Overview

Kashable is an online lending company founded in 2013 and headquartered in New York City.

They offer a socially responsible wellness solution for workers, including postal employees, in all states except West Virginia.

Kashable loan amounts range from $250 – $20,000, with rates starting at 6% APR and loan durations ranging from 6 to 24 months.

Kashable applications take a couple of minutes to complete. However, there may be delays if they have to verify additional information.

Kashable uses your employment and credit data to calculate offers and assign interest rates, and they report payments to all three credit bureaus to help you improve your credit score.

Monthly payments are taken directly out of your paycheck. If you quit your job or get terminated early, you and Kashable will arrange an alternative repayment method, such as ACH payments, checks, or money orders.

Eligibility Requirements

- Your employer must join their program to qualify. They offer an easy way to check eligibility through their website.

- As long as you don’t live in West Virginia, you qualify to apply, and an application takes a few minutes to complete.

- When you apply, Kashable will perform a soft credit check that doesn’t impact your credit score.

- If you choose to proceed with your loan, they will run a hard credit inquiry which may temporarily reduce your credit score.

- You must have a checking account that is active and in good standing for at least 30 days before applying, or Kashable may deny your application.

- You must submit an email address, mobile number, and employee ID. In some cases, they may even request a copy of your pay stub to confirm your employment & income.

Pros

- Low rates with a good credit score

- No prepayment penalties

- They report your payments to Equifax, Experian, and Transunion which

- may help you improve your credit score

Cons

- Higher interest rates with lower credit scores.

- Not available in West Virginia

- Only available through select employers

- They check your credit score and history.

OneBlinc

Overview

OneBlinc is an online lending company founded in 2018 and headquartered in Miami, Florida.

They offer allotment loans to postal and federal employees working in many industries.

OneBlinc loan amounts range from $500 to $3,000, with interest rates ranging between 23% to 32.9% APR, with a minimum of 12 bi-weekly payments and a maximum of 84 biweekly payments.

OneBlinc looks beyond your credit score to approve more applications. They don’t even pull your credit report.

They may add one-time fees ranging from $0 – 88.90 may be added to your loan.

Once you apply, you may have to submit additional documents. Once they are uploaded and marked as “in review,” OneBlinc will respond within 24 hours. Providing incorrect information may delay your application decision.

Eligibility Requirements

- No minimum credit score requirements – meaning you qualify for a loan even if you have a poor credit score.

- No credit checks. They use their risk assessment algorithm using alternative data to make credit decisions and price loans.

- Must work at a company that offers their services as an employee benefit. As long as your company is a partner, you may apply.

- No open bankruptcies. If you have an open bankruptcy record, your application may get immediately disqualified.

Pros

- No minimum credit score

- Lightning-fast approvals

- Easy payment plan

- It helps you build credit.

Cons

- One-time application fees.

- You may qualify for a lower rate elsewhere if you have a good credit score.

- If your employer isn’t part of their network, you can’t apply.

BmgMoney

Overview

BmgMoney is an online lending company founded in 2009 and headquartered in Miami, Florida.

After checking their website, it seems they have a specific landing page dedicated to allotment loans for postal employees.

BmgMoney loan amounts range from $500 to $10,000, with interest rates ranging from 16.99% to 35.99% APR and loan terms ranging from 6 to 36 months.

There are no hidden fees, but they may charge a one-time application fee ranging from $0 – $49 after approval.

To determine eligibility, visit this link and search for your employer. When you apply, BMG Money DOES NOT check your FICO score or credit report. They rely solely on alternative and employment data to underwrite loans.

Once approved, your money will reach your account within 1 – 2 working days.

Eligibility Requirements

- Live in a state where they are legally allowed to operate.

- Be employed by a company they work with

- Be employed for at least one year.

- You have to be at least 18 years old.

- You can’t be active in the military

- No open bankruptcies

Pros

- They don’t check your credit score or credit history. If you have a lower credit score, an allotment loan from BMG money could save you a lot of money.

- Their eligibility requirements are less restrictive than most traditional lenders.

- They have higher acceptance rates than other traditional lenders.

- Instant funding is available when approved.

Cons

- You may find lower interest rates elsewhere if you have a good or excellent credit score.

- You can’t apply if your employer doesn’t offer their loans as an employee benefit.

- They may charge an application fee of $0 – $49

- You have to submit documents for verification.

GetLendly

Overview

Lendly is an online lending company founded in 2019 and headquartered in Dayton, Ohio.

They offer affordable credit access to individuals with positive employment history. They also provide solutions for postal employees.

The lendly team believes you’re more than just a credit score; high-quality employees deserve access to high-quality loans.

Lendly offers loans up to $2,000, with an average interest rate of 175% if you repay through payroll deductions.

Lendly doesn’t have a minimum credit score requirement. However, they require a 6-month minimum for time on the job to qualify.

Eligibility Requirements

- You have to currently reside in one of the following states: Alabama, Arizona, Arkansas, Delaware, Florida, Idaho, Indiana, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Mexico, Ohio, Oklahoma, South Carolina, Tennessee, Texas, Utah, Washington, Wisconsin, and Wyoming.

- Must be employed for at least six months to qualify

- No minimum credit score requirements

Pros

- Easy to qualify

- Good customer service

- Fast funding

Cons

- High-interest rates

- You may qualify for more affordable loans if you have an OK credit score or better.

- Low amounts. You can only borrow a maximum of $2,000

USPS FCU

Overview

USPS FCU is a federal credit union serving its members since 1934. Originally founded to help USPS employees, they now support over 24,000 members.

USPS offers a wide range of services, from checking and savings products to loans and credit cards. If you’re a postal employee working for USPS, you should strongly consider joining USPS FCU.

If you’re looking for an allotment loan, one of the main benefits of joining is you qualify for loans with lower interest and higher approval rates.

Before qualifying for an allotment loan, you must join the credit union as a member. They offer a fully digital application process if you’re interested.

Once your membership is approved, complete the form attached to request an allotment loan.

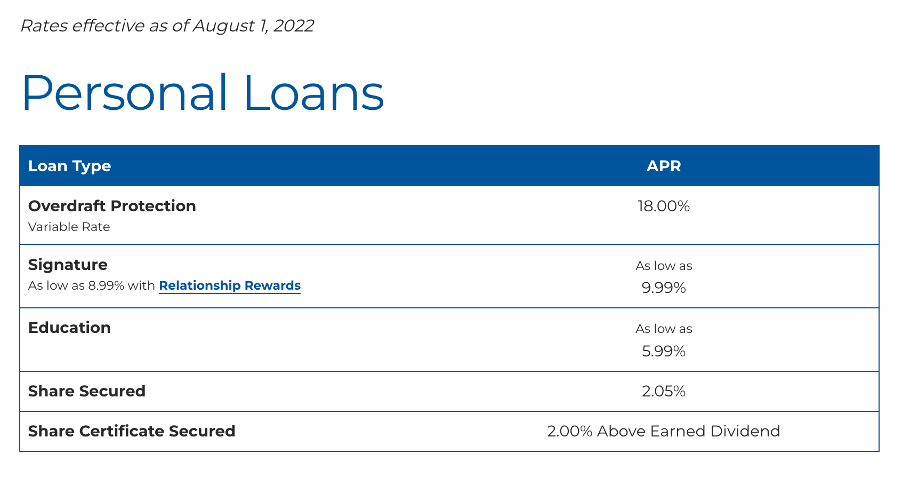

An overview of their rates is below:

Eligibility Requirements

To qualify for an allotment loan through USPS FCU, you must meet their membership eligibility criteria:

- You are eligible if you are an employee or retiree of the United States Postal Service (USPS).

- If you are related to existing USPS FCU members, you are eligible

- If you are the spouse of a person who passed away while holding active membership, you qualify.

- If you’re an employee of a Select Group, you are eligible.

Pros

- Low-interest rates if you are a member

- High approval rates

- Great for postal employees

- A wide range of services beyond allotment loans

Cons

- Only available to postal employees

- Have to sign up as a member before applying for a loan

- You must fill out a loan application form and send it to them instead of a fully digital one.

Workplace Credit

Overview

WorkplaceCredit is an online consumer lending company founded in 2016 and headquartered in Jacksonville, Florida.

They specialize in providing personal financial services to private sector employees, federal employees, including the USPS, and individuals with steady employment history.

WorkplaceCredit offers personal loans repayable through payroll deductions with flexible and affordable terms. You can borrow up to $25,000, repayable over 6 to 36 months. They also charge up to 4% in origination fees.

A key benefit of WorkplaceCredit is that almost everyone qualifies, even if you have bad credit. Additionally, once approved, you could receive your funds in as little as one to two days.

Eligibility Requirements

WorkplaceCredit eligibility requirements are minimal:

- The minimum age to use their service is 18 years old.

- If you have a valid address, you qualify

- You must be a current resident of the United States to qualify.

- You must have been employed for at least 12 months to qualify

- You need an active US bank account to enable loan disbursements.

Pros

- Very few requirements and almost anyone can qualify.

- High approval rates

- Allotment loans specifically for USPS and postal employees

- Get up to $25,000

- Great interest rates if you don’t have a good or excellent credit score

Cons

- If you have a high credit score, you could find a loan with a lower interest rate elsewhere

- Fees and rates aren’t as transparent.

TPA Processing

Overview

TPA Processing is a third-party administrator founded in 2006 and headquartered in Sand Springs, Oklahoma.

As third-party administrators, they primarily provide federal and government allotment support to postal service employees.

While you can’t apply for a loan directly through their website, the company is responsible for helping other institutions offer allotment loans to federal, government, and postal employees.

Access Loans

Overview

AccessLoans is an online lending company founded in and headquartered in Aventura, Florida.

They offer convenient loans to public and private sector employees, including postal workers. They aim to make lending more accessible and transparent while inspiring financially healthier communities.

Access Loans offer loan amounts ranging from $850 to $6,000 with a maximum interest rate of 35.9% APR and terms ranging from 8 to 26 months.

They may request some documents during your application, such as a driver’s license, proof of address, pay stub, and a selfie. The approval process can take as long as two days.

Eligibility Requirements

Access loans have a few eligibility requirements you must consider:

- Must have been employed for at least one year before applying

- Have not recently declared bankruptcy

- Must be over the age of 18

Pros

- The manual document submission process means you qualify even if your employer isn’t directly working with the company.

- Same-day funding available

- No prepayment fees

Cons

- You may qualify for a lower interest rate elsewhere if you have a higher credit score.

- May charge origination fees

- The manual document submission process

- Longer approval times

Coast 2 Coast Lenders

Overview

Coast2CoastLenders is an online lending company headquartered in Miami, Florida.

They specialize in providing allotment loans to federal employees and USPS workers.

Coast2CoastLenders loan amounts range from $600 to $3,000, with interest that change depending on where you reside. They currently offer loans in Delaware, Illinois, Mississippi, Missouri, New Mexico, South Carolina, Tennessee, Texas, Utah, and Wisconsin.

Eligibility Requirements

- Must be a federal, government, or USPS employee

Pros

- A good option if you have a poor credit score and need an emergency loan.

- Higher approval rates for federal and postal employees

Cons

- High-interest rates

- Application fees, allotment fees, and late payment fees

The Bottom Line

If you’d like to apply for an allotment loan, consider one of the following options above.

If you’re looking for an allotment loan with lower interest, higher acceptance rates, and a fully automated application process, consider checking out Stately Credit’s allotment loans instead.