An allotment loan is a type of loan that requires monthly payments to be taken directly out of your paycheck.

The “allotment” system began with the US military in 1889 and has expanded to include civilian federal employees since the 1960s. With the advancement of technology, the “payroll allotment” system for loans is now widely available for employees working in every industry.

An allotment loan could be a great option if you’re struggling to pay bills on time, dealing with an emergency expense, or have a poor credit score. Here’s what you need to know.

How do allotment loans work?

Most allotment loans are unsecured, meaning you do not have to offer any collateral to qualify for a loan. However, monthly payments are taken directly out of your paycheck instead.

Typically, lenders rely heavily on credit scores and credit history when it comes to deciding whether or not to extend an offer.

With allotment loans, lenders are much more lenient and usually approve your loan if you have a stable job with enough income to support your monthly payments.

If you have ever used a service like Plaid to connect your bank account to an app, the process for allotment loans is similar, except that instead of connecting your bank account, you connect your employment account.

You will qualify for a loan if your company uses publicly available payroll software providers like ADP, Paychex, Gusto, or others.

If your company developed custom payroll software, a direct integration may be required and could take up to three to six weeks, depending on the company.

How to pick the best allotment loan.

Some lenders promise instant funding but have lengthy application processes that require manual document submissions. Other lenders have automated application processes but may take up to a week to fund your loan.

Some lenders don’t check your credit score but offer higher interest rates. Others check your credit score and reward positive payment history with lower interest rates.

When it comes to choosing the right allotment loan, you need to consider the following factors:

- The Lender: Some lenders that offer allotment loans specifically focus on the subprime market, i.e., individuals with credit scores of 350 – 600. They typically charge higher interest rates and don’t check your credit. Other lenders target near-prime and prime consumers with credit scores above 600 and do soft credit checks that don’t impact your score to provide offers with lower interest rates. Make sure you apply with a lender that meets your current financial situation.

- The Rate: Similar to other credit applications, it’s always best to prequalify for loans through multiple lenders to compare your interest rate. After receiving numerous offers, formally apply with the lender that offered you the lowest interest rate with the best terms.

- The Process: Some lenders rely on time-consuming manual processes to process loan applications. They may even ask you to submit supporting documents along with your application. Other lenders have fully automated processes that ask you to sign in to your work account so they can prefill your entire application with the information they find on your employment account. Companies like Stately Credit offer fully automated processes that don’t require manual document submissions.

How allotment loans affect your credit score.

An allotment loan affects your credit score much like any other loan or form of credit. If you pay on time, your lender will report your payments to the big three credit bureaus, Equifax, Experian, and TransUnion, and your credit score will go up.

If for whatever reason, you pay late, your lender will also report the missed payments to the credit bureaus, and your credit score will go down.

When you apply for a loan, lenders will prequalify your application by conducting a soft credit pull that does not affect your credit score. If you choose to proceed with a loan, some lenders may decide to perform a “hard credit pull,” which temporarily reduces your credit score by five points.

Do federal employees get better allotment loans?

Yes, federal employees get better loans. They typically receive lower interest rates and higher approval rates compared to employees working in other industries because of the increased job security and pay that federal and government employees receive.

Some companies that offer allotment loans specifically target employees who are working in government agencies. Other companies like Stately Credit offer government employees loans but also serve many industries.

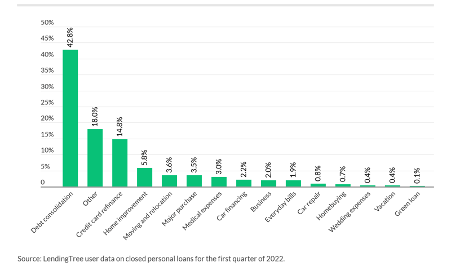

What can I use an allotment loan for?

Like personal loans, you can use an allotment loan to pay for anything you want or need. While the options are vast, we’ve narrowed down the list to a few of the most common reasons for taking out an allotment loan:

Consolidate Expensive Debt: Americans are carrying a whopping $841 billion in credit card debt in 2022. Suppose you are maintaining a balance on multiple credit cards, or you have other loans you’d like to consolidate into one loan with a lower payment. In that case, an allotment loan can help potentially help you save a significant amount in interest. Allotment loans typically have lower interest rates, especially for federal or government employees.

Pay Medical Bills: The annual out-of-pocket costs of medical care ranges from $360 in Hawaii to $1,500 in Nebraska. So, seeking medical attention can be pricey depending on where you live. An allotment loan can help you cover any out-of-pocket medical costs without having to stress about it. Companies like Stately Credit have applications that take less than 3 minutes to complete, and funding is received within 30 seconds.

Repay Student Debt: 43 million Americans carry $1.748 trillion of student loan debt. While the debt accumulation rate is slowing, and recent studies show that most consumers manage their student loan debt efficiently, using an allotment loan to pay off student debt is probably not a wise choice. There are a lot of benefits that come with federal agreements, and you forfeit specific opportunities like deferring payments and flexible payment arrangements if you refinance your student loan with an allotment loan.

Home Repairs & Improvements: Using an allotment loan or personal loan to pay off home repairs and improvements is a widespread use case

Emergency Expenses: When life happens, an allotment loan can help. According to a survey from Bankrate, less than half of Americans have enough savings to cover a $1,000 expense. If you choose to proceed with an allotment loan, similar to the ones offered by Stately Credit, you could receive your funds in as little as 30 seconds after completing your application.

Paying personal debts: Borrowing money from friends and family is always risky. You don’t want to risk your relationship over missed payments. If you owe a relative or friend some money, you can use an allotment loan to help you cover the cost without worrying about it. However, make sure you can afford the monthly payments, or you may damage your credit score and end up in a worse situation.

Paying tax debts: If you owe the IRS, you must figure out a way to repay or face penalties. While getting an allotment loan to pay off your tax debts is a great option to consider, double-check to see if you qualify for an installment agreement with the IRS before seeking a loan from a third party.

Pay for Wedding: Tying the knot is a huge emotional and financial commitment. Wedding costs can add up fast, making it challenging to budget ahead of time. An allotment loan can help relieve the stress from your big day by helping ensure you have enough money to create a truly lasting and memorable experience. Be careful with the temptation to overspend, and ensure you’ll have enough to cover the monthly payments when sober up.

Pay for Divorce: it’s no secret that almost 50% of marriages end in Divorce. According to a survey by Nolo, the average cost of Divorce is approximately $15,500. If you need a loan to cover unwanted divorce costs, an allotment loan can help. Approval and funding times are lightning fast, and as long as you can afford the monthly payments, getting an allotment loan will be an excellent option for your situation.

Go on vacation: Can you take out an allotment loan and blow it all on holiday? Absolutely. Should you? Probably not. Travelling is fun, but you don’t want to end up in debt. Instead of taking out a loan, consider saving up for it or spending a portion of your paycheck.

Finance a vehicle: If you have a good credit score, you’ll qualify for an auto loan with low-interest rates. So, using an allotment loan to finance a vehicle would usually lead to higher interest payments. However, if you have a lower credit score and you’re receiving auto loan quotes of 18% and above, you may be able to save a lot of money by using an allotment loan to finance your vehicle.

Make big purchases: Very few have enough savings to cover significant expenses, so an allotment loan may be a good option if you need to borrow $10,000 or more. Some people may use allotment loans to cover IVF treatments, which can be a life-changing procedure. If you need a large sum of money and don’t mind making monthly payments to pay it off, getting an allotment loan can help.

Cover moving expenses: Moving can be a hassle. An expensive one too. Especially if you need to move furniture, getting an allotment loan to cover moving expenses is a fairly common use case, and companies like Stately Credit can help you with instant funding upon approval.

Buy a pet: Who wouldn’t want a cute puppy or cat? Getting all the supplies needed to look after a pet can be expensive, and an allotment loan can help you cover those costs without breaking the bank.

Pros of Allotment Loans

Allotment loans offer several benefits over other forms of credit. We discuss some of the main benefits below:

Quick Application

Filling out an application for an allotment loan takes less than 5 minutes. With Stately Credit, the application process is even quicker. For example, if you decided to apply with Stately Credit, there would be three main steps. First, you choose how much you want to borrow. Second, you search for your employer and sign into your work account. Third, we prefill the rest of the application with the information found on your payroll account. Review and apply to view your offers.

Fast Funding

Many lenders use a form of Instant Funding to disburse loan proceeds to borrowers. After your application has been approved, you could receive your funds in as little as 30 seconds.

Higher Approval Rates

Lenders can reduce the risk of defaults by linking your loan repayment to your paycheck. As a result, the approval rates for allotment loans are typically higher. As long as you have a stable job and can afford the payments, many lenders that offer allotment loans will accept you.

Lower Interest Rates

Depending on your credit score, some borrowers can save up to 70% with an allotment loan compared to a personal loan. The salary-linked payments help ensure you pay on time, and as a result, lenders usually pass on savings to borrowers through lower interest rates.

More Accessible

If you’re applying for a personal loan or another form of credit, getting approved with a reasonable rate can be challenging if your credit score is below 660. With allotment loans, you secure an affordable rate with a credit score as low as 500. Paycheck-linked lending helps ensure you pay on time, and as a result, lenders can better serve the underserved.

Build Credit

If you have a low credit score or need to establish one, getting an allotment loan can help. Qualifying for an allotment loan is much simpler than other forms of credit like traditional personal loans or credit cards. You will qualify if you have a stable job and have been employed for at least three months. As you make payments towards your allotment loan, your credit score will go up, and the quality of your loan offers moving forward will improve.

Cons of Allotment Loans

While there are many benefits to allotment loans, there are certain disadvantages that you need to be aware of. We discuss the downsides of allotment loans below.

Not Everyone May Qualify

Some lenders require your company to sign up before you get access to allotment loans as an employee benefit. Direct integrations with your employer could take anywhere from three to six weeks, so this isn’t usually an ideal situation. The lenders that use this strategy like this approach because it helps ensure their company remains your company’s primary financial benefit provider. As a result, if you do not work at a company that has previously been onboarded, you may not qualify.

Allotment lenders like Stately Credit do not require your company to sign up beforehand. We integrate with payroll software providers instead, so as long as your company uses a publicly available payroll software provider, you will qualify for a loan.

Increased Debt Load

The typical allotment loan duration is around 24 months, so locking up a portion of your income to repay an allotment loan can potentially lead you into a cycle of debt if the debt you take on becomes unmanageable or unexpected events occur.

If you quit or get fired, you still have to pay

Making payments towards an allotment loan probably wouldn’t be an issue if you had a job. But if you quit or get fired, your loan won’t just disappear. You’ll still have to repay it. If you find yourself in this situation, speak with your lender and ask about deferring payments or coming up with another payment plan until you get another job. Most will be more than happy to help and find a path forward.

How do I get an allotment loan?

Allotment loans have been around for decades, and many lenders have antiquated application processes.

Some may require you to upload pay stubs, W-2s, and other supporting documents with your application.

Others, like Stately Credit, have automated processes that prefill your entire application with the personal information found in your employment account.

Here’s how an allotment loan application with Stately Credit works.

Apply for an allotment loan in six easy steps

Applying for an allotment loan with Stately Credit can be done within minutes.

A six-step process is outlined in detail below:

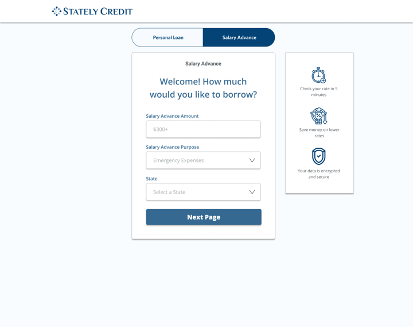

1. Choose a loan type and amount

There are several different types of allotment loans, with the defining characteristic being that monthly payments are taken directly out of your paycheck. When you begin your application with Stately Credit, you have to choose between a personal loan or a salary advance.

Once you’ve picked between the two loan types, enter an amount and reason, and specify which state you currently reside in.

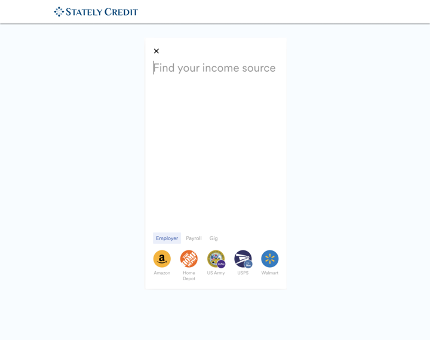

2. Search for your employer

The second step involves finding your income source. You have three options; search for your employer by name, search for the payroll software your company uses, or search for a gig employer like Uber or Lyft.

First, try searching for your employer by name. If you work for a large corporation, chances are you’ll be able to find your employer. However, if you work for a small or medium-sized business and can’t find your employer by name, try searching for your company’s payroll platform. For example, if your company uses ADP, type in ADP.

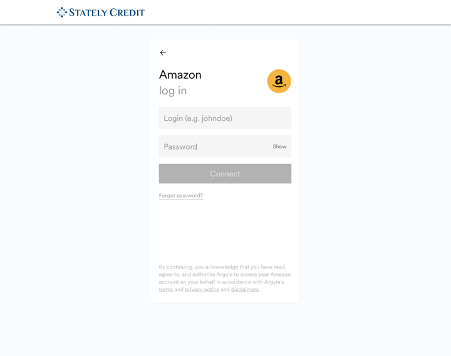

3. Sign in to your account

Once you’ve located your employer or income source, the next step involves signing into your account. If you forgot your username or password, click the “forgot password” link below the “connect” button. You will be redirected to your employer or payroll platform’s account recovery section and will either be able to find your existing info or reset your password.

After signing into your account, our platform will begin the connection process, which could take up to 30 seconds.

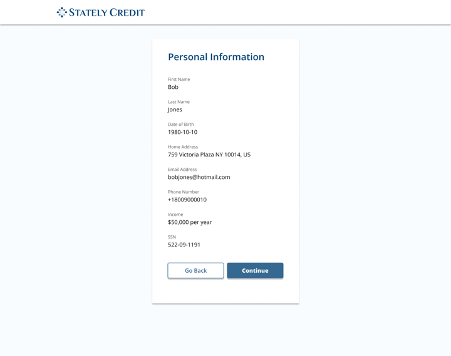

4. We prefill your application. Review your details.

After connecting to your work account, we prefill the rest of your application with the information found on your employment account. Information such as first name, last name, email address, phone number, date of birth, social security number, and income will all be pulled into the application, so you don’t have to type it all out yourself. If your information looks good, continue to the next step.

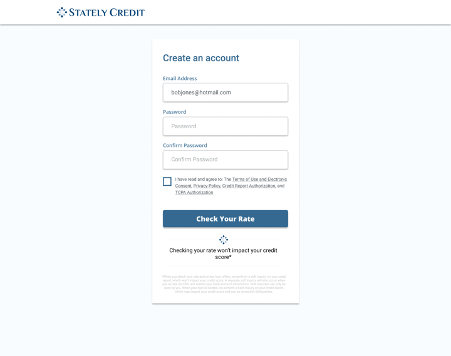

5. Create an account

This is the last step before you finally get to see your rate. Create an account by entering your email address and password and checking the consents & disclosures box. When you click the “Check Your Rate” button, we will perform a soft credit check that doesn’t impact your score. We use this information to set pricing and help reward higher scores with lower interest rates. However, you may still qualify even if you have a lower credit score.

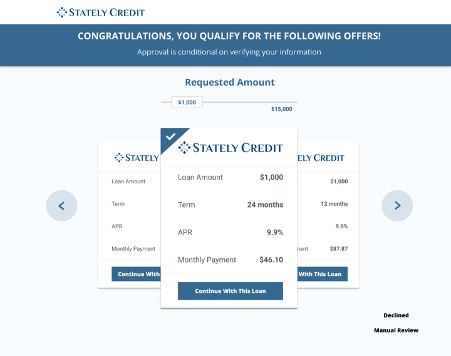

6. View your offers

Voila! After creating your account, you get to see your offers. It usually takes under three minutes to get to this point. Have a look at the offers, and if you like one of them, click “continue with this loan” to sign your contract and provide bank details so we can fund your loan.

Alternatives to allotment loans.

Personal Loan

A personal loan is a type of loan that is repaid in monthly installments, similar to an allotment loan. The main difference between the two products is the repayment mechanism. A personal loan repaid through monthly payroll deductions counts as an allotment loan.

Traditional personal loan companies have strict requirements and may not accept individuals with credit scores below 660. Your interest rates may be higher, or you may not get approved.

If you have a high credit score, getting a traditional personal loan may help you save money because you’ll qualify for the lowest interest rates.

Credit Card

Credit cards allow you to make purchases and repay them at the end of the month without interest or carry the balance and pay interest until the amount has been paid.

Unlike an allotment loan, where you receive a lump sum with a credit card, you get a line of credit with a credit limit you cannot exceed.

You can use some or all of your credit limit towards purchases. You also have the freedom to choose how much you want to repay towards your credit card balance, and the minimum payment amounts are usually relatively small.

If you have a good credit score, you may qualify for the best rates and offers, such as 0% balance transfers and additional perks for signing up. If you have a low score or limited credit history, you may be asked to put up some collateral to open your account, and the cash you put up would act as your credit limit. If you fail to repay your balance, your lender will be able to recover the money directly from your account.

Payday Loan

If you struggle to get approved for an allotment loan and have a poor credit score, a payday loan might be an option.

Payday loans are usually small amounts of money loaned at high-interest rates. Repayment is expected in full on your next paycheck, and if you miss a payment, you risk facing high late fees and rollover fees.

Using a payday loan isn’t advisable because it can typically lead to getting trapped in cycles of debt, especially if you have a low disposable income and cannot afford the large payment on your next paycheck.

Earned Wage Access

Earned wage access is a service that gives you early access to money you’ve already made.

So, if you get paid $20 an hour and work 5 hours, you could get early access to $100 without paying interest. It’s a great option if you need under $500 and don’t mind repaying the balance in full on your next paycheck.

If you decide to use an earned wage access service, make sure you can afford to make the payment at the end of the month. If you use the money to cover an unexpected expense, you may be short of that amount when your next paycheck gets deposited into your account.

Home Equity Loan & Line of Credit

A home equity loan and line of credit are two different products but share one key thing in common. Both products use your home as collateral to secure a loan.

A home equity loan is like getting a second mortgage on your home. You receive a lump sum of money, depending on how much equity you have in the house, and your term would typically range from five to fifteen years.

A home equity line of credit is like a credit card, except that your home is used as collateral. You can borrow as much as you want, up to a specific limit, and if you pay off the balance before a particular date, you won’t be charged any interest. However, carrying that balance forward may result in additional interest payments.

With both products, if you fail to repay on time, your home could be repossessed. The interest rate you receive compared to an allotment loan will be lower, but if you face unforeseen financial hardships, you could lose your most valuable asset.

401(k) Loan

If you contribute towards an employer-sponsored retirement plan, you could borrow money against those funds to cover emergency expenses. Unlike other forms of credit, such as allotment and personal loans, you won’t have to submit many documents to qualify for a loan. Even if your credit score is very low, you could still receive a 401k loan because there aren’t any minimum credit score requirements to qualify.

However, there are a couple of downsides to consider. If you take out a 401k loan, you’re essentially paying income tax twice. You pay income tax when you earn a salary and withdraw money from your retirement plan. If you’re worried about your current job security, it’s best to reconsider a 401k loan. If you leave your current employer or get fired, you will have to pay more taxes on the amount you borrowed if you don’t repay the balance in full within 90 days because, after that point, it would be considered a taxable distribution.

Salary Advance

A Salary Advance is a type of loan that allows you to borrow money against your paycheck, regardless of your credit score. It’s typically for smaller amounts, usually under $2,500.

Asking your employer for a Salary Advance can be awkward, which is why companies like Stately Credit have begun offering Salary Advances online directly to employees. Similar to allotment loans and payroll deduction loans, a salary advance application follows the same process.

If you have a low credit score or no credit score at all, a Salary Advance could be a great fit.

Peer-To-Peer Loan

Peer-to-peer loans are a type of loan where borrowers apply online and are funded by individual investors instead of large financial institutions.

A company like Prosper or Peerform may act as a middle-man in the transaction and either approve or deny loans before they get sent to a marketplace.

Once the approved loans enter the marketplace, individual investors can view specific loan details and decide whether they want to invest or not. Investors can commit to a small portion of the loan or purchase the entire loan outright.

A benefit of this lending is that individual investors may be willing to overlook some aspects of your credit report and payment history if the loan terms are reasonable.

The Bottom Line

An allotment loan can help cover emergency expenses and other use cases. They typically have lower interest and higher acceptance rates than other loans. If you’re interested in getting an affordable loan to help you save money, consider Stately Credit and apply for our allotment loans when you need help.