A salary advance is a loan that allows you to borrow money directly out of your paycheck. You can use the money to pay for unexpected expenses or other bills like gas, food, rent, etc.

A traditional salary advance from your employer would have to be repaid in full on your next paycheck. That includes the total amount you borrowed, plus interest and fees.

However, a salary advance loan from companies like Stately Credit allows you to repay the balance in monthly installments over a year. Spreading payments out over 12 months can help make it more affordable.

How do salary advance loans work?

A salary advance loan and the process behind applying for one is similar to most installment loan applications.

First, you pick a lender and begin filling out an application. If you choose Stately Credit, we ask you to log into your work account so that we can prefill your entire application.

After you apply, your lender will review your information and decide whether to offer you a loan or not.

Loan decision systems are typically fully automated, so you should expect to receive a response within minutes.

If you like the offer, continue your application by signing a contract and setting up payroll deductions.

Loan repayments will come directly from your paycheck each month, so you don’t have to worry about missing a payment.

After your loan is fully paid off, the payroll deduction will disappear.

Do salary advance lenders check your credit score?

Some lenders check your credit score and reward positive payment history with lower interest rates.

Other lenders don’t check your credit score and charge higher interest rates.

Beyond your credit score, credit bureaus store thousands of data points related to your payment history, ability to pay, and willingness to repay. Lenders use these data points to create their scoring models.

How do salary advance lenders calculate your interest rate?

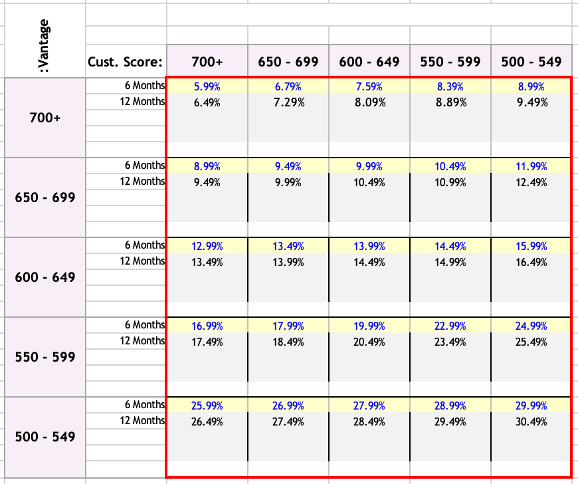

One strategy that lenders use to calculate your interest rate is known as a “Risk-Based Pricing Matrix.”

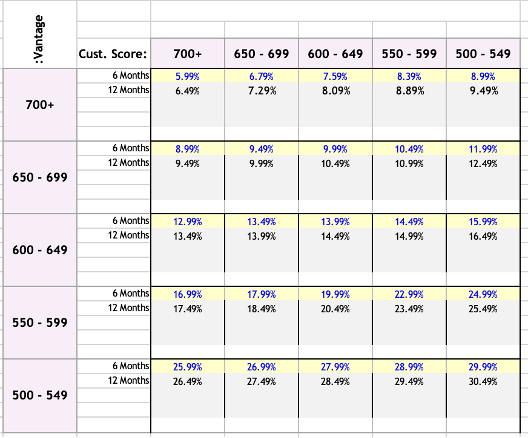

It’s a 5 x 5 table with your Credit Bureau Score on one axis and a custom score that your lender creates on the other.

A 5 x 5 risk-based pricing matrix looks something like this:

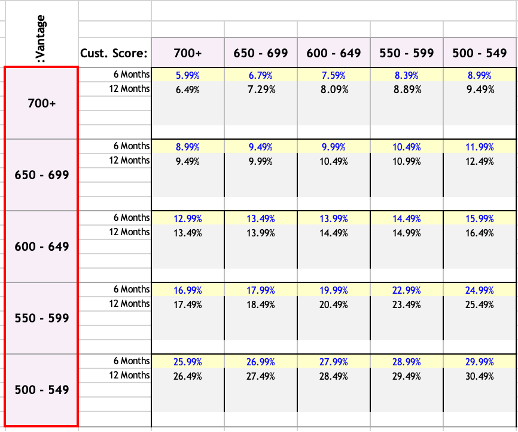

In the image below, the Vantage Score section is outlined in red. To clarify, not all lenders use the Vantage score. Others prefer to use Fico. Either way, the area outlined in red relates to a three-digit credit score received by any of the three main credit bureaus, Equifax, Experian, and TransUnion.

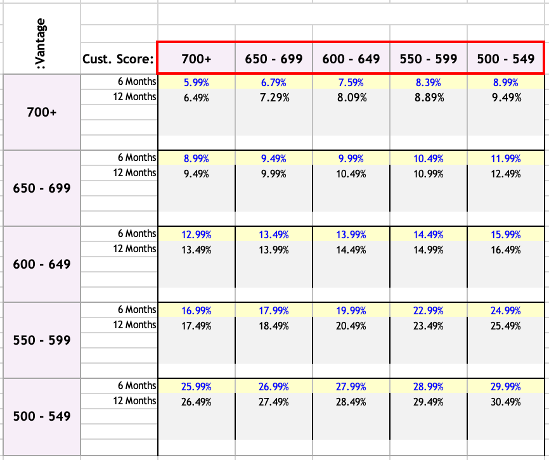

Next, the custom score is outlined in red in the image below.

A custom score is a three-digit score that your lender creates using data supplied by credit bureaus.

They use thousands of data points that relate to your payment history, ability to pay, and willingness to repay to create a custom score.

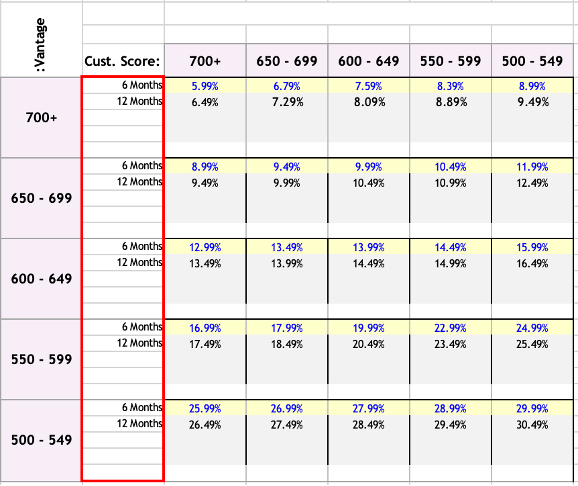

In the image below, you’ll see the offers section outlined in red. Borrowers can repay salary advance over 12 months, so we calculate two offers—one for six months and one for twelve months.

And finally, we have the interest rate section highlighted in the chart below.

This is where your lender will configure rates depending on loan profitability and loss rates. If they find that specific categories of borrowers are performed worse than others, they may choose to raise interest rates to a point where the loans become profitable again.

As you can see, the credit score you receive from Credit Bureaus isn’t the only factor that goes into pricing your loan, and every lender has their way of calculating a custom score to feed into the risk-based pricing matrix.

We will discuss how lenders underwrite loans in more detail later.

How to pick the best salary advance loan

In many ways, the process behind choosing the best salary advance loan is the same as if you were applying for any other credit product. However, there are a few key differences.

Some companies only offer salary advances to employees at companies that have been previously onboarded. If your HR department hasn’t signed up first, you may not be able to apply for a loan.

However, others, like Stately Credit, do not require your company to sign up first. Have a look to see if you qualify before applying for a salary advance.

Beyond that, I recommend looking at three key factors:

- Affordability: Check the interest rate and fees before you apply. Some lenders offer high-interest salary advances, while others perform a soft credit check and reward you with lower interest rates. Some may have a bunch of hidden fees, while others have no fees at all.

- Convenience: Salary advance loans have been around for decades, in one form or another. Several Credit Unions offer Salary Advance loans, but you have to be an existing member, and the application process can be pretty tedious. Manual document submissions are required, and automated decisions aren’t guaranteed. On the other hand, over the past couple of years, companies like Stately Credit have begun offering fully automated Salary Advance application processes. Log into your work account (i.e., ADP, Gusto, or your company payroll account), and we will prefill the rest of the application for you. If you care about convenience, the application process will be a critical factor to consider before you apply.

- Accessibility: Check to see if your lender’s program covers your employer. For example, Stately Credit currently covers approximately 80% of the American workforce. You can apply for a loan if your company uses a publicly available payroll software provider like ADP, Paychex, Gusto, or others. Other lending companies only offer salary advances to employees at specific companies as a voluntary benefit. If your company hasn’t signed up beforehand, you may not qualify. Accessibility is a significant factor when considering which salary advance lender to use.

Will my employer know that I’m borrowing money?

It depends. If you requested a salary advance directly from your employer, it would be impossible for them not to know about it.

However, if you get a Salary Advance from a third-party company like Stately Credit, your employer wouldn’t know.

The reason why your employer wouldn’t know has to do with the way loan payments are taken out of your paycheck. Let’s talk about that next.

How do payroll deductions for loan repayments work?

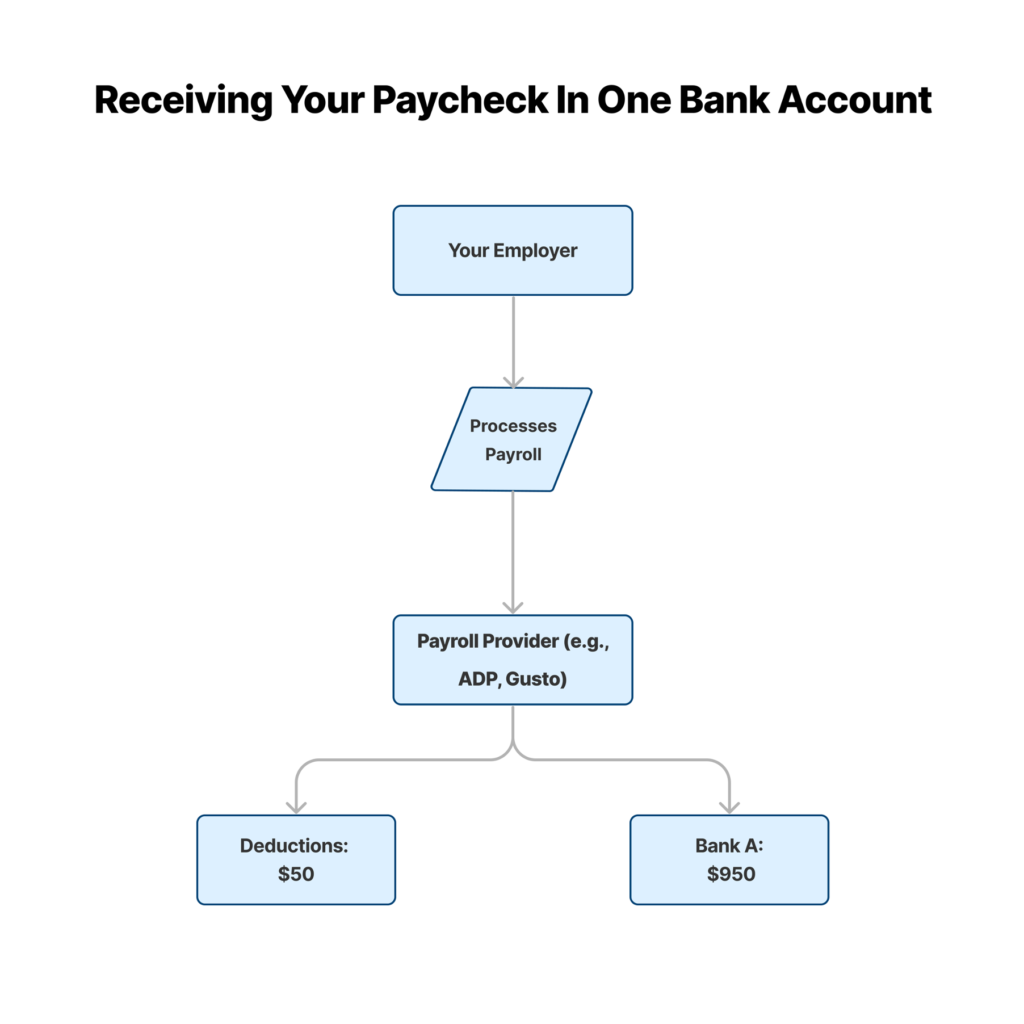

You’re probably familiar with how traditional payroll deductions work. Your employer withholds a certain amount from your monthly paycheck to pay for certain benefits, like health insurance, retirement plans, and more.

When your employer deducts an amount from your paycheck, it shows up on your payslip as a deduction.

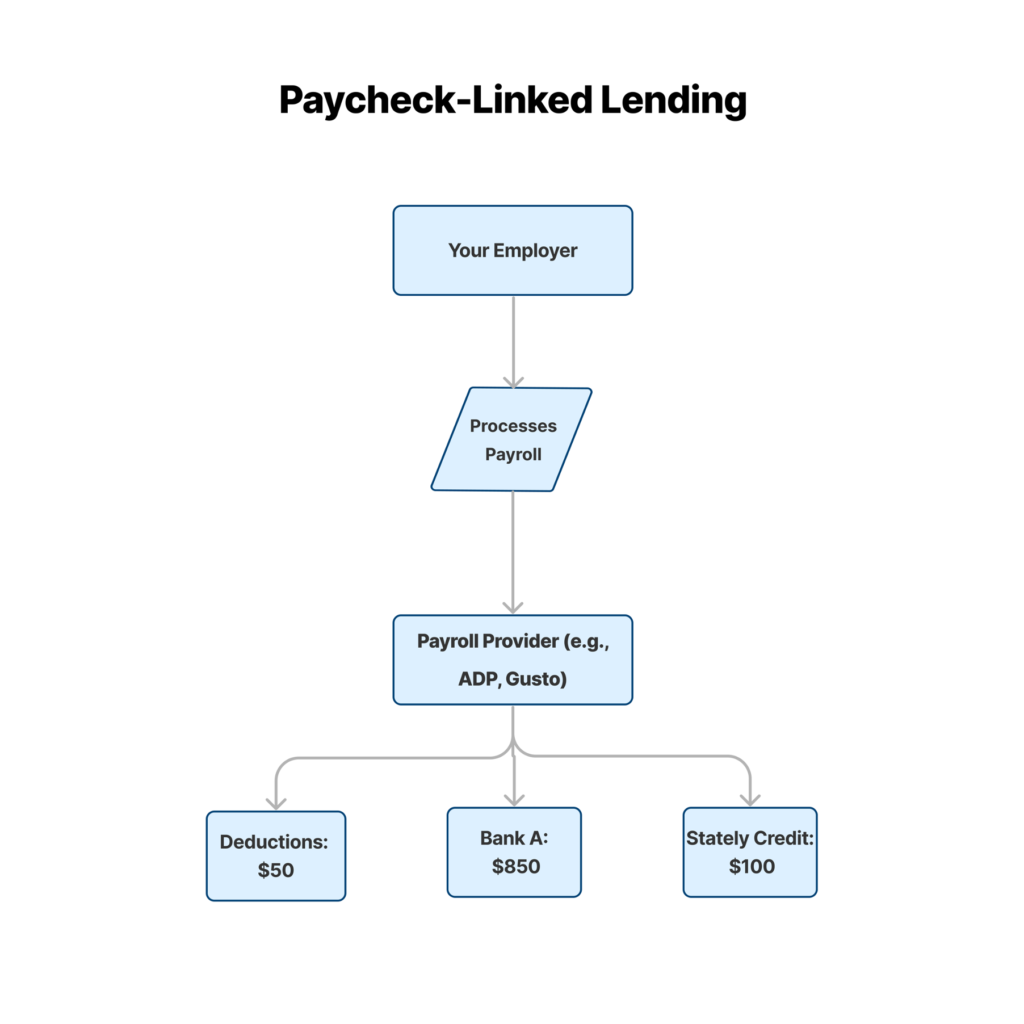

However, the payroll deduction process for loan repayments works a little differently, and it’s part of why companies like Stately Credit can guarantee complete privacy.

Payroll deductions for loan repayments operate more like “direct deposit switches .”Here’s how.

Let’s say you get paid $1,000 each month. Your employer deducts $50 from your paycheck, leaving you with $950. When you got hired, you instructed your employer to send your money to a specific bank account that you control, which we will call account A

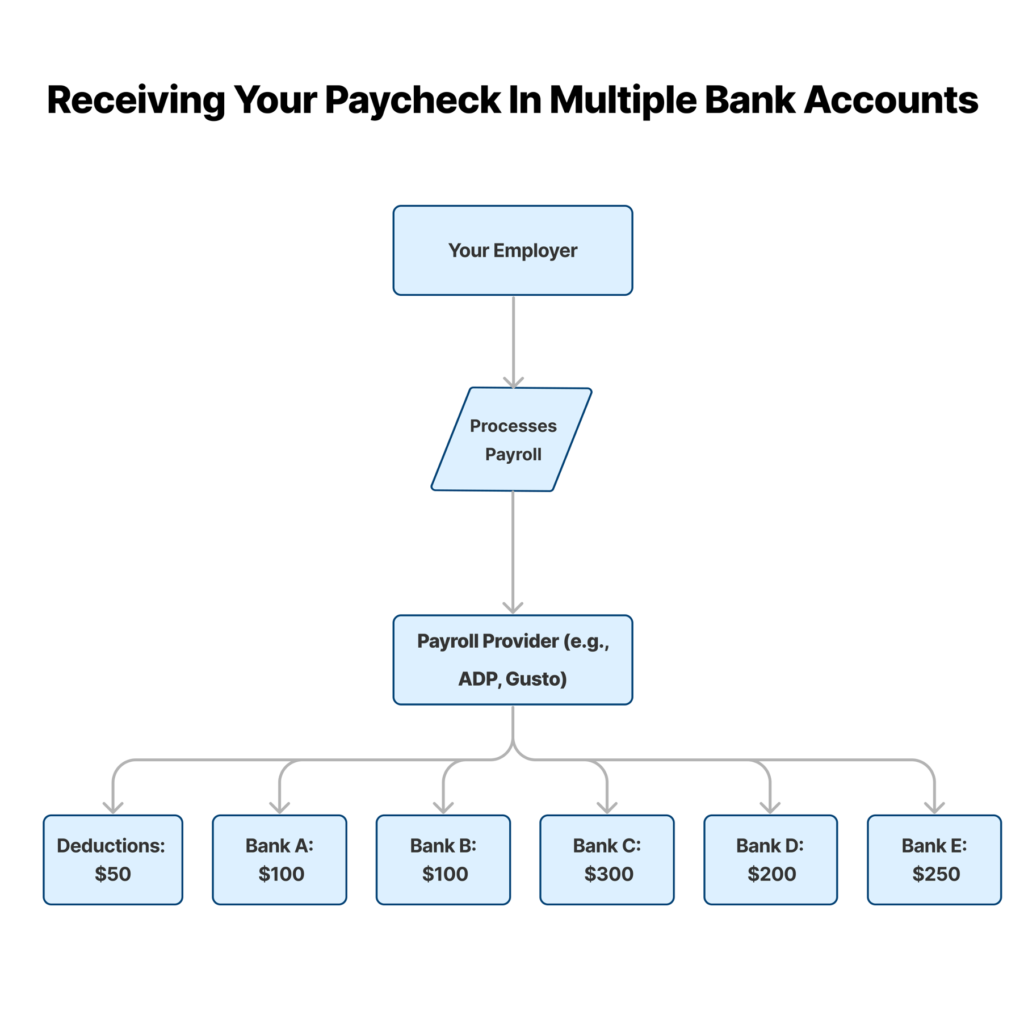

You have the legal right to determine how many and which bank accounts you wish to receive your paycheck. If you wanted to, you could split your $950 paycheck into five different accounts, like in the example below.

Let’s say you decided to borrow some money from Stately Credit, and the monthly payment towards your loan is $100.

When you sign up with Stately Credit, you essentially allow us to redirect a portion of your paycheck to pay off your loan. Standard payroll deductions are entirely different.

After your loan is paid off, the direct deposit switch will disappear, and you will receive your entire paycheck again.

When you receive your payslip at the end of the month, you will not see any payroll deductions for loans. You will see that $x has been sent to your primary bank account while $x was sent to another bank account discretely controlled by Stately Credit or any other payroll deduction loan company.

What happens if I can’t afford to repay?

We’ve all been there, and honesty and transparency go a long way if you can’t afford to repay your loan on time. Here are some of your options if you can’t afford to pay your loan on time:

Pay Later

If you can’t afford to pay on time, paying later is better than never. Most lenders won’t report a missed payment to the credit bureaus if received within 30 days.

If you can make a payment towards your loan within the 30-day window, your credit score won’t get damaged, which will undoubtedly help if you are considering our next option on the list.

Refinance or Consolidate Your Loans

If you’re paying off multiple loans or stuck with high-interest rates, you should strongly consider consolidating your debts into a single loan with a lower payment.

You could significantly reduce your monthly payment by consolidating your debts with a payroll deduction loan or personal loan.

The additional savings could help ease the debt burden and ensure you make payments on time.

If you haven’t been more than 30 days past due on your current accounts, your credit score could have improved since you last applied for a loan.

Search for different debt consolidation loans to see if this option suits you.

Talk to your lender

If you missed a payment, the best thing you can do is speak with your lender. Explain your situation and the reason why you couldn’t pay on time.

If you’re honest about a situation and open to finding a solution, your lender will most likely offer a payment plan to help you get back on track. If you lost your job or primary source of income, they might even be willing to defer your payments or pause interest temporarily.

Consider a secured loan.

If you have money in a savings account or other assets you could pledge as collateral, getting a secured loan is an affordable way of helping you pay off your salary advance loan.

Instead of getting a traditional debt consolidation loan, which typically offers an interest rate in the mid to high teens, getting a secured loan will help you secure the lowest possible interest rate you can use to pay off your salary advance.

If you don’t have any assets like a car, house, emergency savings, or others, this option may not be the best fit for you. Consider a debt management plan instead.

Try using a debt management plan.

Sometimes, a little help is all we need to get back on track and pay off debts. A debt management plan is similar to a debt consolidation loan, except that a non-profit credit counseling agency typically offers them.

After engaging with the non-profit credit counselor, they will lump all your various loan products into a single loan with a lower interest rate. They will negotiate with creditors on your behalf to secure better terms and will take control of making payments on time.

Each month, your payments will get sent directly to the credit counseling agency, which will then make payments to creditors on your behalf. A debt management plan is an effective way to get out of debt if you need help.

What can I use a salary advance for?

A salary advance loan can be a lifesaver if you need some cash to cover a short-term emergency.

If you’re having trouble paying bills on time or have a low disposable income, getting a salary advance loan can help you avoid expensive overdraft fees or payday loans.

Below, we discuss some of the most common use cases for salary advance loans.

Cover emergency expenses

Asking friends and family for money can be awkward.

If you’re dealing with an unplanned expense and need money right away, getting a salary advance loan can help.

Once you’ve been approved, most lenders use a form of instant funding so the money you borrowed could hit your account in as little as 30 seconds.

Pay for bills

Banks charged American consumers $12.4 billion in overdraft fees in 2020; the average overdraft fee is around $24.38.

If you’re struggling to pay bills on time, getting a salary advance loan can help you avoid expensive overdraft fees that consume your disposable income.

Pay for food and rent.

The prices for food and rent have been skyrocketing since the pandemic, with no signs of slowing down any time soon.

Families across America are feeling the effects of inflation, and if you need money to pay for groceries, gas, or rent, a salary advance loan can help you.

Where can I get a salary advance loan?

Suppose you’re looking for a salary advance loan. In that case, you can get one in one of two ways: By joining a credit union that offers salary advance loans or by finding a lender like Stately Credit that offers salary advance loans directly to consumers.

Credit Unions

Each credit union has its terms & conditions and requirements for qualifying for a salary advance loan.

Credit unions typically want you to join as a member before accessing their products and services.

Some credit unions are even more restrictive and focus on offering services to specific people, such as teachers, government employees, the military, or employees working at particular companies and industries.

Not all credit unions offer salary advance loans, so make sure you find one that does.

Stately Credit

Companies like Stately Credit offer salary advance loans directly to consumers.

You don’t have to apply to become a member before qualifying, and filling out an application takes less than 3 minutes.

If you’re interested in learning more about salary advance loans through Stately Credit (shameless plug), visit our website.

How do I apply for a salary advance loan?

Applying for a salary advance loan is a simple process, depending on who you use with.

Getting approved and funded could be tedious and time-consuming if you’re requesting a salary advance loan from your employer.

Suppose you’re applying for a salary advance loan from a Credit Union. In that case, you may have to wait a month after getting your membership approved before you’re allowed to submit a salary advance loan application.

On the other hand, a salary advance loan application from Stately Credit could get approved and funded within minutes.

Below, we discuss a three-step process for applying for a salary advance loan.

1. Pick a lender

The first step of the process involves choosing your lender. Pick between your employer, a Credit Union, or a company like Stately Credit.

Once you’ve picked a lender, begin the application process.

2. Fill out an application

If you’re applying for a salary advance loan with Stately Credit, you must log into your employment account (or retrieve your details). We prefill the rest of the application with information we find in your payroll account.

Other salary advance lenders may ask you to fill out an application manually. If they do, you will typically be asked to provide the following information:

- First Name

- Last Name

- Date of Birth

- Email Address

- Phone Number

- Social Security Number

- Address

- City

- State

- Zip Code

- Employer Name

- Job Title

- Employee ID

- Annual Income

- Additional Income

- Account username and password

3. Review your offers

If your application was approved, review your salary advance loan offer.

If you’re happy with the interest rate and monthly payments, complete your loan by signing a contract and providing your bank account info about where you wish to receive your funds.

Monthly payments will be taken directly from your paycheck, and the salary deductions will disappear when the loan is fully paid.

Pros and cons of salary advance loans

While salary advances are an excellent option for dealing with short-term cash flow issues, there are several downsides you need to be aware of.

We discuss the pros and cons of salary advance loans in detail below.

Pros of salary advance loans

One of the main benefits of Salary Advance loans is that they can be used as an affordable alternative to payday loans.

A salary advance would be a perfect fit if you have a lower credit score or have never applied for a credit product.

Some of the other advantages to salary advance loans are as follows:

- Easy to qualify for: A salary advance loan would be perfect if you have a low credit score or a thin file with the credit bureaus. Because payments are taken directly from your paycheck, many lenders don’t have minimum credit score requirements. Qualifying for a salary advance loan is much easier than other credit products like personal loans.

- Lower Interest Rates: Most salary advance lenders cap interest rates at 18% to 36% while charging no more than $20 as an application fee. Compared to payday loans or some personal loans, salary advance loans have lower interest rates and more attractive terms.

- Higher Acceptance Rates: Considering that monthly payments are linked to your salary, the chance of you defaulting on a loan is much lower. In return, salary advance lenders typically have higher acceptance rates than traditional loans and credit products.

- Avoid Expensive Overdraft Fees: Small financial shocks could lead to enormous consequences if you live paycheck to paycheck with a low disposable income. If a bill takes you into overdraft, your bank will average charge you around $35. A salary advance loan can help you avoid expensive overdraft fees by ensuring you have enough money to pay bills on time.

- Cover emergency Expenses: If you’re dealing with an emergency expense, and need cash in a hurry, a salary advance loan can help. After your loan is approved, the money could hit your bank account in as little as 30 seconds. Check to see if your lender offers instant funding because if they use ACH, your funds could take as long as 3 – 5 days to reach out bank account.

Cons of salary advance loans

A salary advance loan may not be a good fit for everyone. You could find loans with lower interest rates elsewhere

with a higher credit score.

If the salary advance loan program doesn’t cover your employer, you may not even be able to apply.

We go through all the disadvantages of salary advance loans below:

- If you have a good credit score, the interest rate is too high: If your credit score is above 650, you could qualify for a larger personal loan with a lower interest rate. Salary Advance loans are mainly for people with lower credit scores or thin files at credit bureaus.

- Some lenders require your company to sign up first: Some companies offer salary advances exclusively as an employee benefit. If your employer hasn’t been onboarded first, you won’t be able to submit a loan application. Other lenders like Stately Credit don’t have those requirements, and anyone can fill out an application through the website.

- Your employer may not be covered: A direct integration is unavoidable if you work for a government agency that has developed proprietary payroll software. Completing a direct integration could take anywhere from 3 to 6 weeks if your employer is interested in partnering with the company you’re looking into.

- Long application process with credit unions: If you apply for a salary advance loan through a credit union, the application to become a member can be quite long. After you’ve been approved as a member, you may have to wait up to a month before you’re allowed to submit a salary advance loan application.

Salary advances vs. payday loans

A payday loan is a type of short-term loan where lenders will extend high-interest credit regardless of your credit score.

Repayment is expected in full on your next paycheck.

Also known as cash advance loans or check advance loans, the high-interest rate and short repayment period typically trap people in cycles of debt they find hard to escape.

On the other hand, a salary advance loan was designed as an affordable alternative to payday loans.

People with low credit scores or thin files at credit bureaus can easily qualify for a salary advance loan and repay the balance over six to twelve months.

The lower monthly payment helps ensure affordability and prevents people from getting stuck in debt with high rollover and late fees.

Salary advances vs. earned wage access.

Earned wage access refers to a product that gives you early access to money you’ve already made.

If you get paid $10 an hour and work 8 hours on Monday, you could advance up to $80 without paying any interest.

Earned wage access products aren’t loans; they must be repaid in full on your next paycheck.

Some earned wage access providers charge a subscription fee, others ask for tips, and some require you to spend money on their branded debit card so they can collect interchange fees and offer you salary advances for free.

A Salary Advance, on the other hand, is a loan. Instead of repaying the loan in full on your next paycheck, salary advance lenders give you up to 12 months to repay.

The lower monthly payments make borrowing for emergency expenses more sustainable. Instead of charging subscription fees, asking for tips, or insisting you switch banking providers, salary advance lenders charge interest.

Salary advances vs. personal loans

A personal loan is a type of loan you repay monthly. With a personal loan, you can borrow up to $25,000 with interest rates as low as 5.9% APR. Typical loan terms extend to 36 months but can go as far as 72 months.

Getting a personal loan may be more suitable if you have a higher credit score. On the other hand, if you have a lower credit score, a salary advance loan would be more appropriate.

Approval rates are higher for salary advances, so if you’re worried about your credit history and don’t mind paying between 18% to 36% APR for a loan, consider applying for a salary advance.

Salary advances vs. payroll deduction loans

A payroll deduction loan is similar to a personal loan, except that monthly payments are taken directly from your paycheck.

They are similar to Salary Advance loans, except that minimum and maximum loan amounts are higher.

Similar to personal loans, I suggest you apply for a payroll deduction loan if you have a higher credit score.

If you are worried about your credit score or history, I suggest applying for a Salary Advance loan, as the chances of getting approved are much higher.

Salary advances vs. payday alternative loans

Payday alternative loans were created to help eradicate predatory lenders that trap hard-working Americans in cycles of debt. A Payday alternative loan allows you to borrow up to $500, with interest rates capped at 18% to 28%, with a $20 application fee.

Salary advances and payday alternative loans are the same product but have different names.

If you need a short-term loan as soon as possible, consider applying for either a salary advance loan or a payday alternative loan.

The Bottom Line

If you need money in a hurry, a salary advance loan can help. Interest rates are lower, and approval rates are higher than other credit forms.

As an affordable alternative to expensive payday loans, salary advance loans have become much more popular over the last couple of years.

Many credit unions across the US already offer Salary Advance loans, along with companies like Stately Credit which offer them directly to consumers.

Check out our website to learn more about our salary advance loans.