If you’re living paycheck to paycheck and struggling to make ends meet, borrowing a little cash to help you get by seems like an obvious choice.

However, if your only options are expensive payday loans, with rates ranging from 391% to 521%, taking out a loan could significantly impact your finances.

With such high-interest rates and fees, you could get trapped in a cycle of debt; And according to the CFPB, 80% of payday loans get taken out within two weeks of paying off a previous payday loan.

Instead of borrowing money from predatory lenders, you should consider payday alternative loans instead.

What is a payday alternative loan (PALs)?

A payday alternative loan is a short-term small-dollar installment loan with repayments secured by monthly payroll deductions. Federal Credit Unions (FCUs) offer these types of loans to help provide access to affordable credit to cover emergency expenses.

Payday alternative loans provide a temporary lifeline to borrowers without trapping them in cycles of debt with unrealistic payment schedules and sky-high fees.

Instead of giving borrowers up to 14 days to repay, a payday alternative loan allows repayment terms ranging from 1 – 12 months.

Interest rates are capped between 28%, with a single application fee of up to $20, even for borrowers with low credit scores who would otherwise only qualify for an expensive payday loan at 391% APR.

What are Payday Alternative I Loans (PALs I)?

The National Credit Union Association (NCUA) amended its regulatory framework in 2010 to create a viable alternative to payday loans.

The PALs I rule allows a federal credit union to offer a form of short-term credit that is less expensive than payday loans but have higher rates than traditional personal loans.

These types of loans are allowed as long as they get structured correctly.

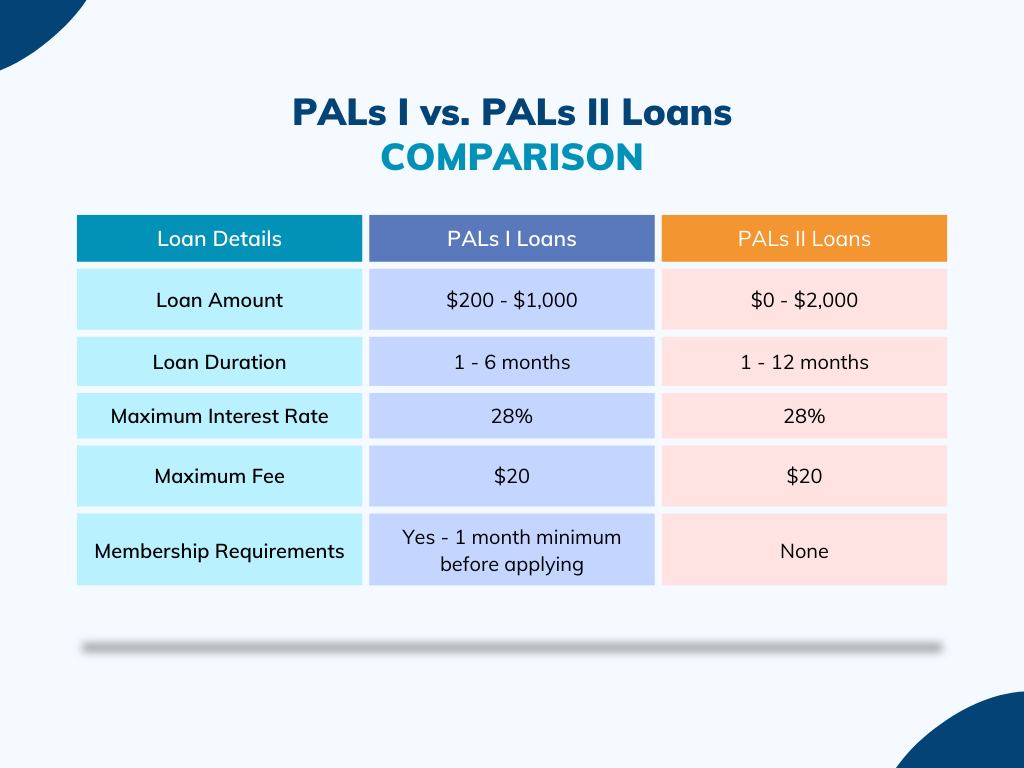

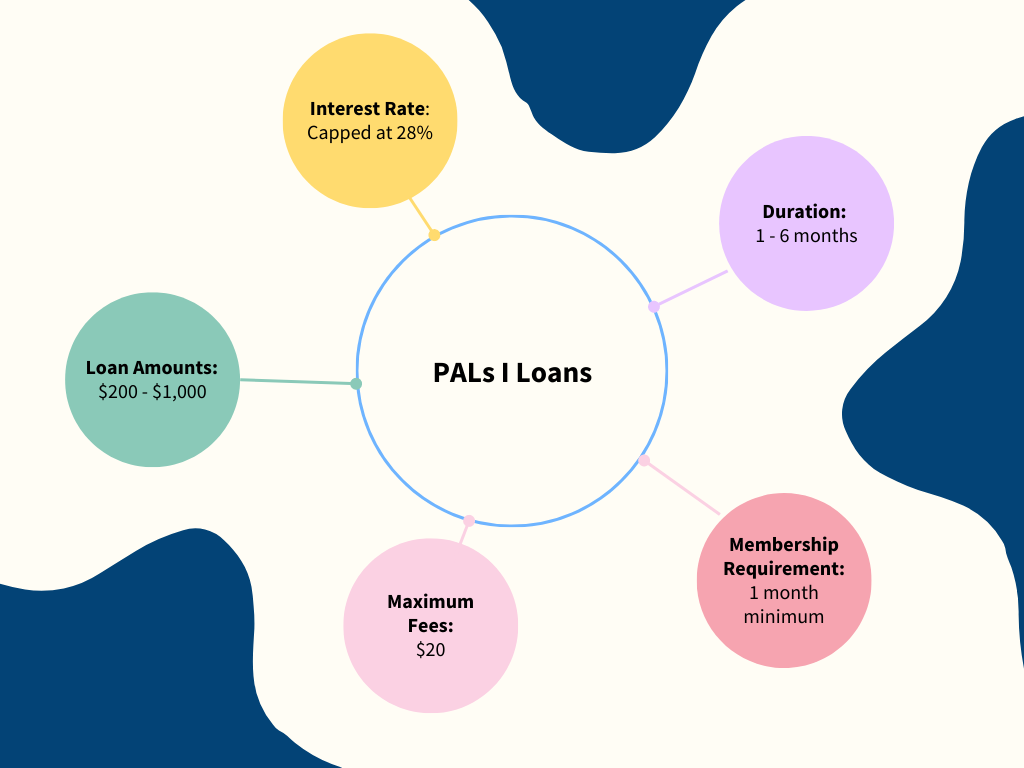

Here’s an overview of how PALs I loans are structured:

- Loan Amount: $200 to $1,000

- Loan Duration: 1 to 6 months

- Maximum Interest Rate: 28%

- Maximum Fee: $20 to cover the application

- Membership Requirements: You must be a credit union member for at least one month before qualifying.

The program was a huge success. As of September 2011, 372 federal credit unions were offering Payday Alternative I loans with an aggregate balance of $13.6 million. This amounts to 36,768 outstanding loans.

As part of the initial 2010 ruling that made PALs I loans possible, the board decided to review PALs I lending data after a year to re-evaluate the loan terms and make improvements where necessary.

What are Payday Alternative II Loans (PALs II)?

The NCUA board amended their general lending rule in 2018 to allow federal credit unions to create a new payday alternative loan, also known as PALs II loans.

The purpose of the new amendment wasn’t about replacing the existing PALs I loan. It was about allowing credit unions to offer a more flexible type of PALs loan appealing to more borrowers.

While the two types of payday alternative loans have their differences, they must satisfy similar regulatory requirements tailored to each specific product.

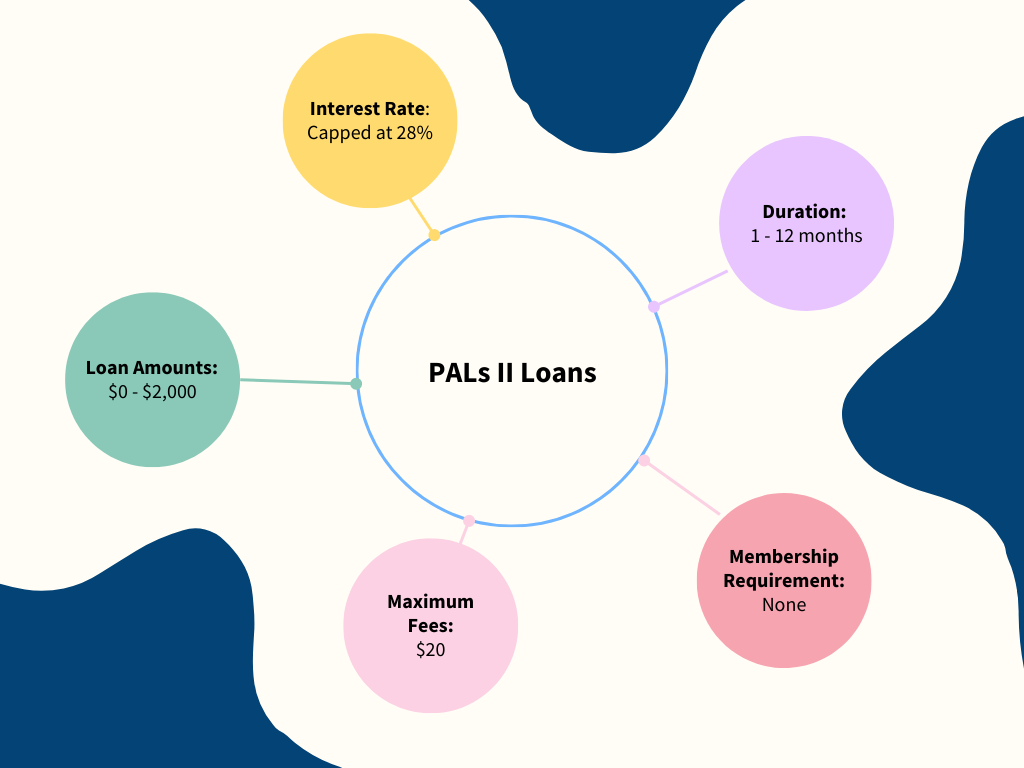

Here’s an overview of how PALs II loans are structured:

- Loan Amount: $0 to $2,000

- Loan Duration: 1 to 12 months

- Maximum Interest Rate: 28%

- Maximum Fee: $20 to cover the application

- Membership Requirements: You are immediately eligible, with no waiting period required.

Payday loans vs. payday alternative loans

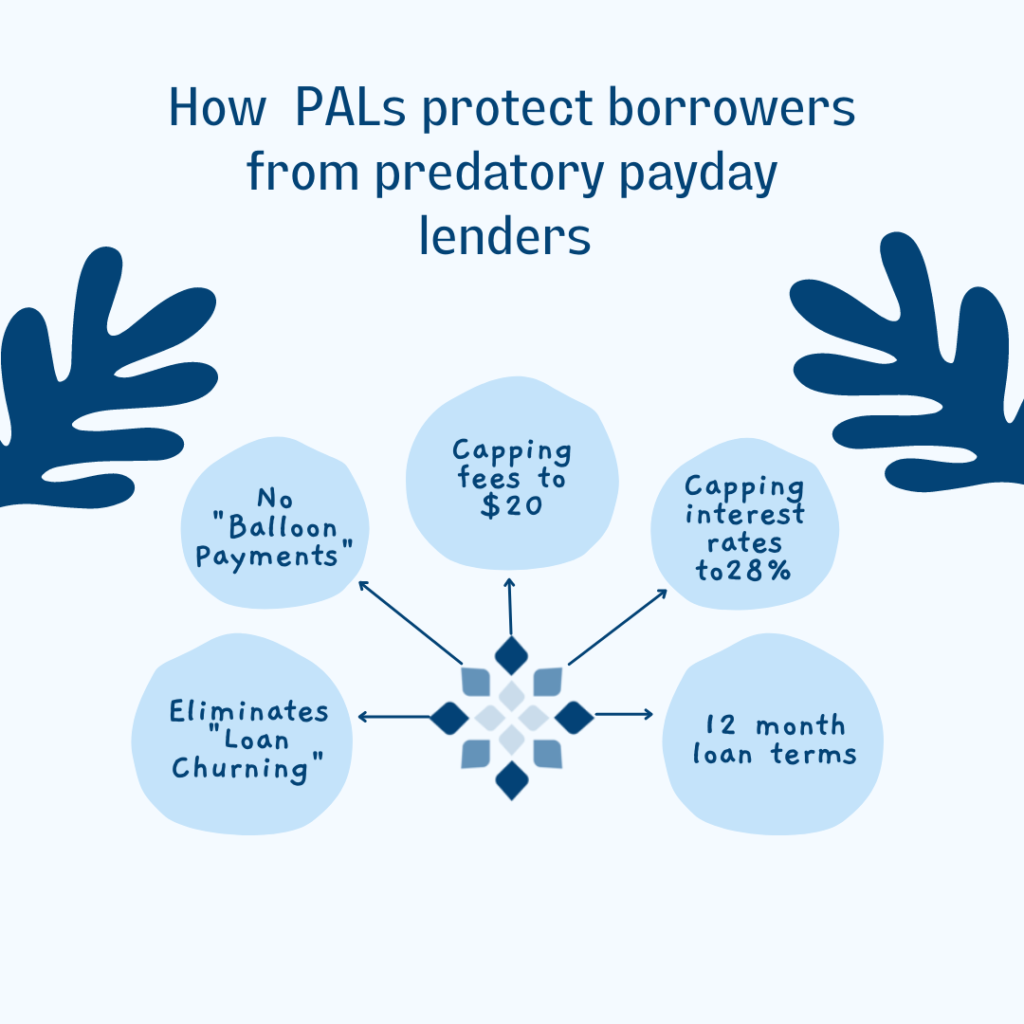

The NCUA board structured PALs loans in a way that helps protect borrowers from predatory lenders that offer loans designed to trap their customers in cycles of debt.

Here are some of the structural benefits of payday alternative loans compared to traditional payday loans:

Preventing Rollovers

PALs loans solve a particular and prevalent problem with payday loans – the concept of “loan churning.” Loan churning is where borrowers take out a new loan to pay off the old one.

“Rolling over” a loan can lead to significant fees and penalties, amounting to substantially more than the initial amount borrowed.

By providing a longer repayment term, borrowers reduce the risk of missing payments that incur expensive fees.

Another feature of PALs I loans is that lenders can extend the loan’s due date without requiring additional fees.

Eliminating Balloon Payments

Traditional payday loans must be repaid in full the next time you receive a paycheck. So, if you needed $300 to cover an emergency expense, you’ll have to repay around $360 – $400 the next time you get paid.

Very few have the disposable income necessary to support such a high monthly payment, so they miss due dates, roll over the loan, and incur high fees that add up over time and eventually trap them in cycles of debt.

Discouraging Repeated Borrowing

By limiting the number and amount of fees that financial institutions charge, the PALs rule removes economic incentives for encouraging borrowers to take out multiple loans.

Suppose credit unions and other lenders were allowed to charge high application and origination fees. In that case, there may be an economic incentive to let borrowers continuously roll over their loans if they can’t afford to make the balloon payment.

Creating a path to mainstream financial services

By removing economic incentives to develop predatory lending products, PALs I loans provide borrowers with a natural pathway towards mainstream financial services and traditional loans with lower interest rates.

Where can I get a payday alternative loan?

Two main ways to get a payday alternative loan are through a federal credit union or through lending companies like Stately Credit.

As of December 2017, 518 Federal Credit Unions reported offering payday alternative loans, totaling 190,723 outstanding loans with an aggregate balance of $132.4 million.

By searching “Payday alternative loans credit union” on google, you will find dozens of potential credit unions looking for new borrowers.

You could also try searching for a local credit union through MyCreditUnion.gov to evaluate your options.

Alternatively, you could try applying for a Salary Advance from Stately Credit.

Salary Advances from Stately Credit share the same structural features as PALs II Loans, and the application process is fully automated.

How do I qualify for a payday alternative loan?

According to the NCUA guidelines, there aren’t any minimum credit score requirements when qualifying for a payday alternative loan.

Instead, each credit union has the right to determine its underwriting criteria.

However, considering PALs are an affordable alternative to payday loans, it’s safe to say that the credit score requirements are much less stringent than other borrowing options.

Some credit unions and companies don’t even perform credit checks, and instead, all they want to see is evidence that your membership is active and currently in good standing.

Apart from verifying your income & employment with pay stubs or bank statements, the application process is quick and straightforward.

How do I apply for a payday alternative loan?

If you’re applying for a PALs loan through a credit union, your first step involves filling out an interest form similar to the one below.

After completing your interest form, a representative from your chosen credit union will get back to you and let you know how to complete an application.

If you applied for a PALs I loan, you might have to wait a month before you’re allowed to complete an application. However, if you applied for a PALs II loan, you don’t have to wait before applying.

The information your credit union will need is similar to what you’re used to providing on traditional credit applications. A list of the most common information fields is below:

- First name

- Last name

- Date of birth

- Email address

- Phone number

- Home address

- City

- State

- Zip code

- SSN

- Annual income

- Additional income

- Education History

- Job title

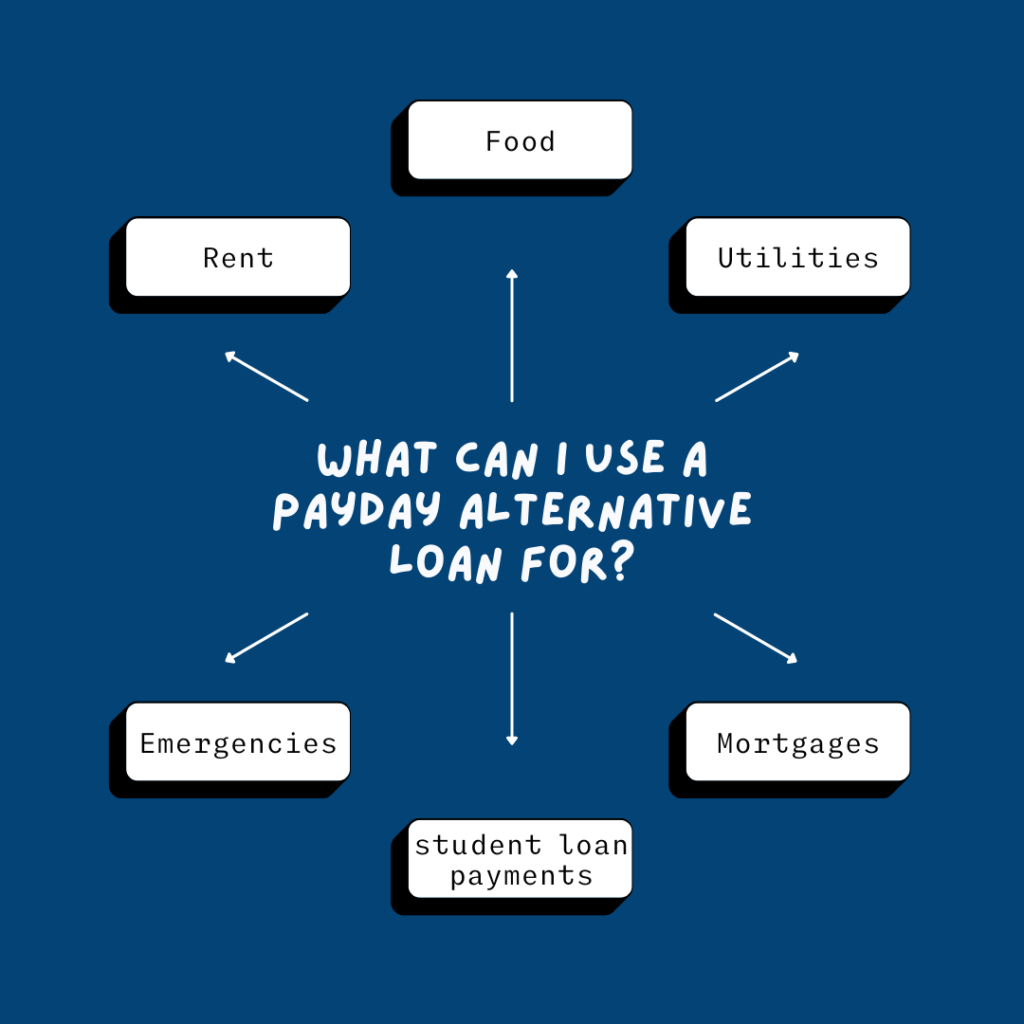

What can I use a payday alternative loan for?

As a form of short-term credit, a payday alternative loan can benefit people facing ongoing cashflow issues or dealing with financial emergencies.

People use payday alternative loans for many of the same reasons as traditional payday loan borrowers.

According to a study, 69% of borrowers used these loans to cover everyday expenses like utility, rent, mortgages, food, student loan payments, and more.

A longer repayment window makes it easier for borrowers to use payday alternative loans to cover essential bills or avoid expensive overdrafts.

Pros and cons

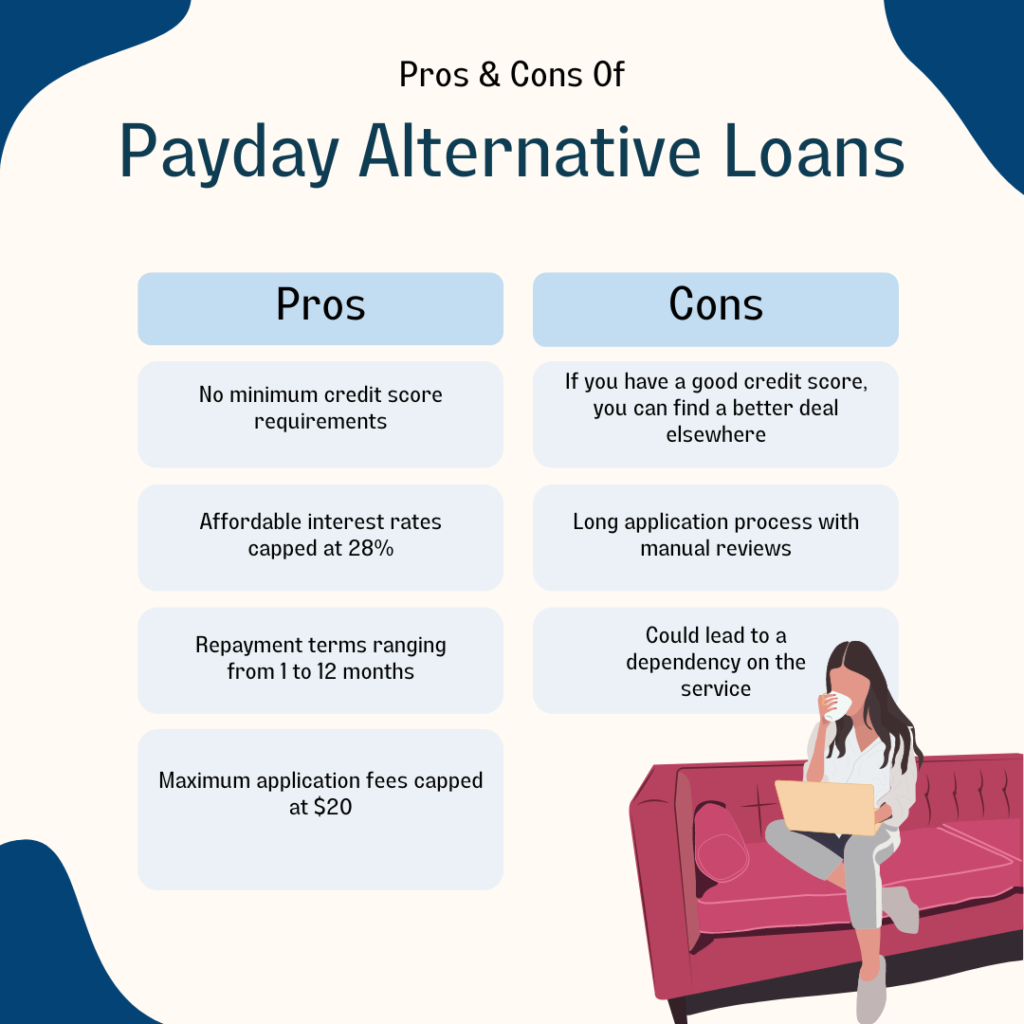

Pros

- Minimal Requirements: Getting a payday alternative loan is much simpler than applying for a traditional credit product like a personal loan. There aren’t any minimum credit score requirements, and payday alternative loans are affordable for borrowers stuck with predatory loans. Some lenders won’t even check your credit score. Many institutions will approve your application if you have an active credit union membership.

- Affordable Rates: The average APR on a payday loan is 391%. Compare that to payday alternative loans with strict interest rate caps of 28% and maximum fee amounts of $20. Both products target the same type of borrower, but one has a significantly lower rate with better terms, while the other traps people in cycles of debt.

- Good Terms: Traditional payday loans give borrowers around 14 days to repay their loan in full. Very few can afford such high balloon payments and instead choose to roll over their loans and incur hefty penalties. With a payday alternative loan, borrowers get anywhere from one to six months to repay their balance.

- Cap on Fees: Payday alternative lenders cannot charge more than $20 in fees. Compared to payday loans, which have dozens of fees, having a cap ensures that payday alternative loans remain affordable for the masses.

- Safeguards: With payday alternative loans, borrowers are limited to one active loan and cannot take out a new loan to pay off their old one. Having these safeguards in place helps ensure that borrowers don’t get trapped in cycles of debt.

Cons

- Can be expensive: If you have a good credit score, you qualify for many traditional loans with lower interest rates. Getting a payday alternative loan at a 28% interest rate may seem extremely expensive if you are eligible for loans as low as 5.9%.

- Borrowing is too easy: Getting a payday alternative loan is very easy and could lead to a dependence on the service.

- Long Application Process: If you’re applying for PALs I loan, you may have to wait an entire month after joining the credit union before you’re allowed to apply for a payday alternative loan. Once you submit a letter of interest, you have to schedule a call with a credit union representative to discuss the next steps with your application. Getting a payday alternative loan may seem longer and more complicated than traditional loans.

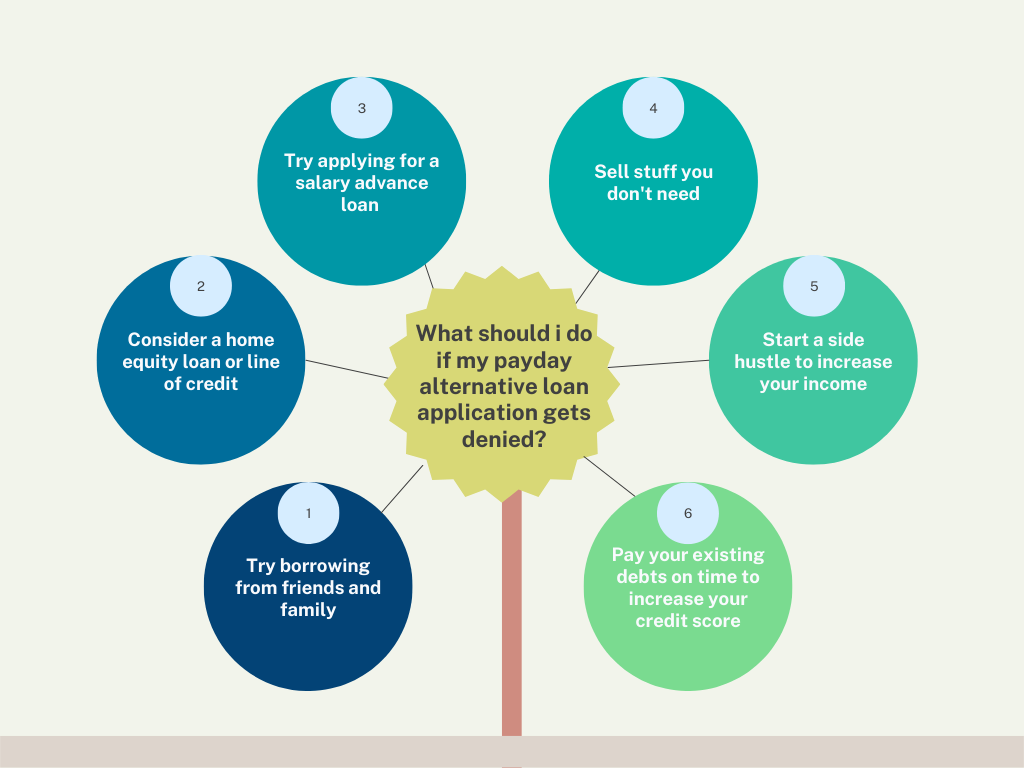

What should I do if my application gets denied?

Borrow from friends or family

A payday alternative should be your last resort. If you can borrow money from friends or family, that’s usually your best option.

Your family or friends probably won’t charge you interest, or at least as high as traditional lenders will. Try speaking with family and friends before you apply for a payday alternative loan.

Home equity loan or line of credit

Getting a loan with a low credit score can be challenging. But none of that matters if you have assets to pledge as collateral. Even if you have the lowest possible credit score, you could secure a loan with a low-interest rate if you had assets like a house to pledge as collateral. While the offer you receive may be significantly lower than an unsecured loan, the risks are much higher. If you fail to make payments on time, you risk losing your house.

Salary Advance loan

Lenders like Stately Credit offer credit products that are nearly identical to payday alternative loans. If you can’t get a payday alternative loan, try applying for a salary advance loan instead.

Sell items you don’t need

We all have things lying around the house collecting dust. If you have some stuff you don’t need, consider selling them to raise some extra money.

Increase your income

Consider a side hustle to make some extra money. There are dozens of ways you could turn a profit in your spare time. Try following this guide for more tips and information.

Build credit

A higher credit score will lead to better offers. If you have outstanding loans, make sure you don’t miss a payment. If you do, your lender will report it to the credit bureaus, and your credit score will drop, making it harder to qualify for more loans.

The Bottom Line

Payday alternative loans can be a lifeline for people who need access to affordable credit and can’t get it.

Before 2010, if you had a poor credit score, your only option would be to get an expensive payday loan with an average interest rate of 391%.

Now, if you need access to affordable credit and have a poor credit score, you could get a payday alternative loan with a 28% interest rate and a maximum fee of $20.

While hundreds of credit unions offer payday alternative loans, start-ups like Stately Credit have begun offering a similar credit product called Salary Advance loans and payroll deduction loans.

Salary Advance loan and payroll deduction loan applications are fully automated and don’t require any document submissions.

On the other hand, payday alternative loans have manual application processes, with lots of document submissions and manual review steps before you get approved.